How to Talk Finances with Your Partner (& 30 Financial Questions to Ask handout)

With Valentine’s Day around the corner, it’s easy to get wrapped up in that lovely-dovey feeling. But likely not every moment with your loved one is full of bliss, right?

Believe it or not, finances are the number one source of relationship stress, according to a 2015 SunTrust Bank survey. You may be nodding your head in agreement after having experienced this yourself.

Or you may be raising your eyebrows in surprise. No matter your reaction, we can probably agree that talking finances with your partner is important in every relationship.

But finances are a touchy subject for many people. Everyone has a different background and approach to finances. Even if two people use the same budgeting method, they may differ on their spending and saving habits and their financial priorities.

We’re not exactly like our partners when it comes to every other aspect of life, so it’s logical that we wouldn’t approach finances the same either. This is where conflict can come in.

Disclosure: This post contains affiliate links. This means that I may receive compensation when you click on a product link or purchase an item linked on this site. Click here for details.

Here are a few examples of financial differences that may lead to conflict:

One person spends extra disposable income while the other wants to save it. He may not mind having a small amount of savings and using it from time to time, while she may want to build a large nest egg for retirement.

One person is comfortable keeping a balance on his or her credit card while the other pays off all debt as soon as possible.

One partner is in charge of the couple’s finances and the other partner is unhappy with his or her spending being supervised.

Large amounts of student loan or consumer debt that aren’t shared until well into the relationship or even after getting married.

So when should you talk about finances in a relationship?

There’s no right time to bring up the talk about finances. During the first few dates is probably too early. Likewise, waiting until marriage is too late.

Some couples bring it up when they become serious about their relationship or when planning to move in together. Likely by then, you’ll have some idea about your partner’s finances from spending so much time with him or her.

When you do decide to have the talk, here are 8 tips to guide your conversation. (Since my partner is male, I use “he” when talking about a partner here.)

1) Schedule a money date or meeting

To avoid surprising or cornering your partner on a touchy subject, agree in advance to set aside some time to discuss your finances together. Give your partner at least a few days to gather up his financial information and formulate his thoughts.

2) Show paperwork

Hopefully by this point, you trust your partner at his or her word. But don’t be afraid to ask to see his paperwork if seeing actual numbers would ease your mind.

These could include pay stubs, bank account statements, credit card balances, credit reports, and more. Be open with your paperwork and he’ll likely be more open with his.

3) Ask about financial problems or debt

Nowadays, it’s common for people to have financial problems or debt, even if it’s considered good debt like student loan debt. My friends who are doctors, lawyers, and nurses, and I came out of our schooling with debt.

Similar to above, don’t be afraid to ask about it. Also, being open about financial problems you have or had in the past will likely help your partner be more revealing about his.

4) Discuss with an open mind

Even if you don’t like what you hear, try to keep the meeting a discussion where both parties can speak and be heard without fear of judgment. If you hear something you don’t like, ask for details in order to try to understand your partner’s decision making.

You both may agree that he made a wrong move somewhere, but refrain from making him feel judged for it. This is only the first conversation and if it goes well, you’ll set a good precedent for future discussions about finances and other hard-to-broach topics.

5) Value what your partner brings to the table

You’re with him because you love him, so pay attention to all the good things your partner brings to the relationship too. Perhaps he mentions that he hustled to build an emergency fund or that he worked hard to get a promotion at work. Compliment him on what he’s done so far and know that those good qualities will help him in the future.

6) Explain your point-of-view

If you find yourself in the hot seat over past or current financial decisions, calmly explain to your partner how you got into the situation and your plans for getting out of it. You may have gone to a private college or graduate school and accumulated six figures of debt.

Educate him on how you plan to manage and pay off your debt by showing him facts and figures. Then ask for time and understanding to show him that you’re on the right track.

7) Make mutual actionable steps for change

If you decide to take action on you own or his finances, decide on actionable and achievable steps for positive change. Instead of saying that you’ll save more, decide on a specific amount (e.g., $500 a month) and how you will achieve it (e.g., eating in for a month).

You can wait until your next meeting to decide on changes or to start implementing changes if it’s too much to do right away.

8) Allow time for progress

If you decide to make changes, agree to a time period to allow your partner or yourself to make those changes. He may need a few months to tackle his credit card balance, or you may want a few months to increase your income from side jobs.

This is just the start, so periodic check-ins and ongoing discussions with your partner will help keep you on the right track.

Related Posts

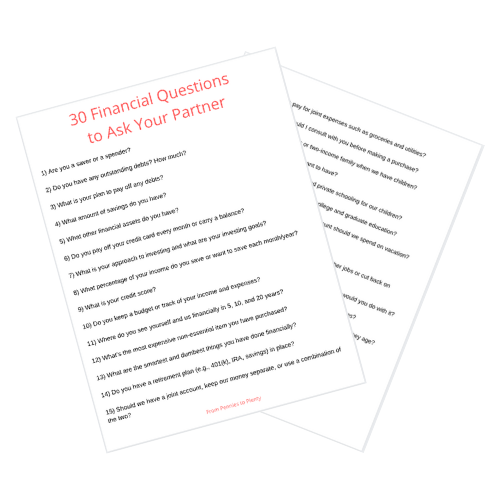

To help you facilitate the discussion, I’ve created a list of 30 financial questions to ask your partner. These questions cover a variety of topics related to money.

Feel free to tackle them all at once or a few at a time depending on your needs. Find them in the Free Resource Library.

Source:

“Love and Money: People Say They Save, Partner Spends, According to SunTrust Survey,” Feb. 4 2015, SunTrust.com