I remember back a few years ago when I started my new job and decided to create a new budget using an Excel spreadsheet. I thought that there must be a better way than what I was doing.

I was estimating amounts for each of my budget categories and then trying to track everything in and out month after month. Not fun!

So I started researching budgeting methods and I came across one called the 50/20/30 budget. I liked it right away.

It’s simple and straightforward to keep your spending and personal finance on track. So if you’re currently looking for a budgeting method, this may be just the one for you.

Disclosure: This post contains affiliate links. This means that I may receive compensation when you click on a product link or purchase an item linked on this site. Click here for details.

How it works:

The 50/20/30 budget calls for allocating certain percentages of your total take-home pay to specific categories.

50%

Fifty percent of your budget goes towards living essentials. This includes housing, transportation, utilities, groceries, and out-of-pocket health insurance. You might consider your cell phone and home internet service as essential if you need these for work and daily life.

Take a look at your paycheck to determine your take-home pay. If you get paid twice a month, it may be helpful to determine your monthly take-home pay for ease of overall calculation.

Calculate what 50% of that would be. Then add up the cost of all your living essentials and see how the amounts compare. A good goal would be to keep your essentials to 50% or less of your budget if possible.

20%

Twenty percent of your budget goes towards savings. This includes emergency funds, rainy day savings, retirement savings from take-home funds, investments, and payments towards debt.

While money used for paying off debt does not actually go into your savings account, it is included in this category. A good goal here would be to shoot for a savings rate of 20% or above.

30%

Thirty percent of your budget goes towards personal spending. This can also be considered all non-essentials.

Items in this category include entertainment or fun money, meals out at restaurants, clothes and shoes, gifts, personal travel expenses, a Netflix account, and an Amazon Prime account.

A good goal here would be to keep personal spending to 30% or less if your budget.

Why I like this method:

I’m a fan of this budgeting method because it’s so easy to use. It’s easy to tell if you’re off-track simply by adding up your expenses and seeing if your categories match the 50, 20, and 30 percentages.

You still have to fill in every line of your budget, but you don’t have beat yourself up over every cent spent on every line. This method provides a bigger-picture look at your finances.

It’s important to point out that the 50/20/30 budget doesn’t work for everyone in this form.

Depending on you individual circumstances such as where you live, how many children you have, your income, and your life goals, you may find that different proportions work for you.

A young adult living at home with his family may only need to allocate 40% of his budget to living essentials because he doesn’t pay rent.

A person with a significant amount of student loans may require more than 20% of her budget go towards the savings category in order to make her required monthly payments.

If you want to save for a down payment on a house, you may need to increase your savings category percentage to 30% or 40% to meet that goal.

A person who is aiming for early retirement may want to cut back on all extra expenses and aim for a 50% savings rate to make it happen.

This method provides a starting point for budgeting before venturing from it and finding out what works for you.

Example

Let’s say that Penny is a single 20-something office worker in San Francisco. Here’s a basic rundown of her hypothetical financial situation in order to see how this method works.

Income: $50,000

Take-home pay: $36,000 or $3,000 a month

Living essentials:

Rent: $1500

Transportation: $150

Utilities: $30

Groceries: $200

Internet: $20

Cell phone: $50

Total: $1950/3000 x 100 = 65%

Savings:

Student loans: $300

Emergency fund: $200

Retirement fund: $100

Total: $600/3000 x 100 = 20%

Personal spending:

Entertainment: $100

Clothes: $100

Meals out: $100

Gifts: $25

Travel: $75

Other: $50

Total: $450/3000 x 100 = 15%

From these calculations, you can see that Penny’s budget looks like 65/20/15 rather than 50/20/30. This may be a reasonable budget in some places, but if Penny is looking to reallocate her budget to reflect the model, there are a few things she can do.

She might want to look for cheaper housing or spend less on groceries each month. At 20% though, her savings is right on target.

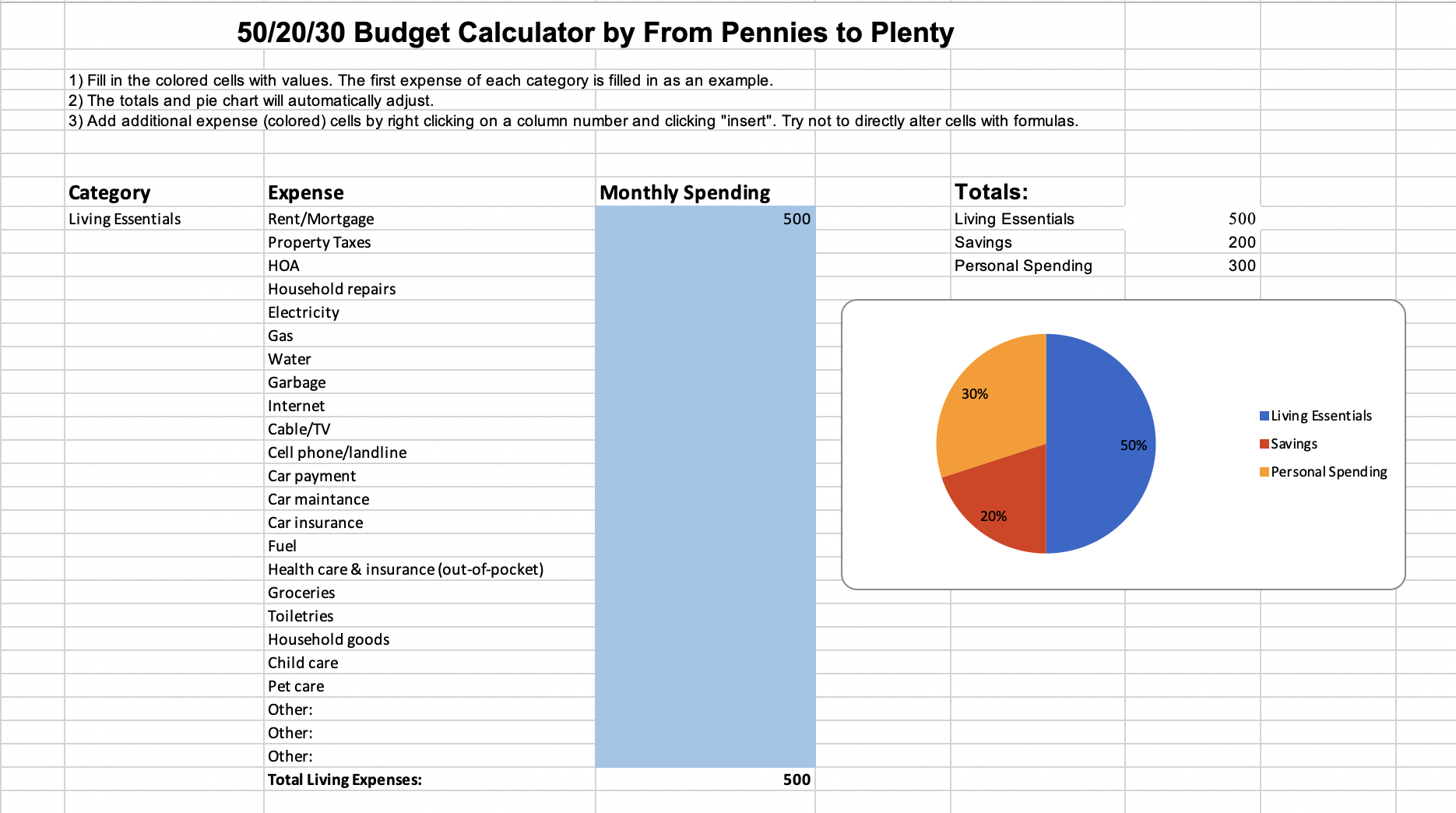

Click on the picture below to download a copy of the 50/20/30 budgeting calculator (Excel spreadsheet).

What is your experience using the 50/20/30 budgeting method? What do you think of it?