8 Money Saving Challenges to Start the New Year

The new year is on the horizon. There’s nothing like a new year to get people excited about change, challenges, and goals.

One popular goal is to save more money. It can be really tough to save money. You have necessary expenses like housing and food and sometimes unexpected ones like medical care or a car problem.

Or you might just enjoy spending money. Whatever your reasons for spending, you know it’s a good idea to save and you’re motivated to do it now.

That’s why I put together this collection of money challenges to help you start the new year. Sometimes all it takes is a challenge to get you going on that path to your goals.

Someone thinks you can’t do it? You’re gonna prove them wrong! Because these challenges are the blueprint for more saving more in less time.

Disclosure: This post contains affiliate links. This means that I may receive compensation when you click on a product link or purchase an item linked on this site. Click here for details.

1 | 52-Week Savings Challenge

The 52-Week Saving Challenge has you save incrementally more each week over the course of a year. You start by saving $1 during week 1, $2 during week 2, and so forth until you save $52 during week 52.

Following this challenge, you’ll have $1,378 saved at the end of the year. Does this sound difficult? Here some tips and tricks to work around that:

Pay yourself first. Put money into a separate account or container before you spend on anything else.

Start the challenge going backward. Save $52 in your first week and $1 in week 52. This is helpful if you have a harder time saving towards the end of the year.

Share your goal so that you’re openly held accountable.

There are a lot of variations on this type of challenge. Some are for a certain amount of days or weeks. Others change up the amount of money to save each week.

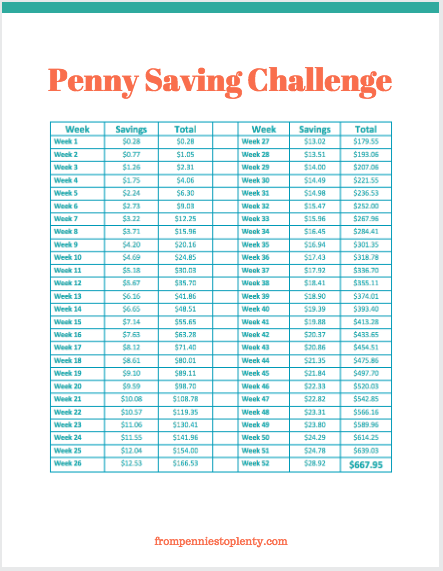

2 | Penny Challenge

In the penny challenge, you start out collecting a penny on day 1 and collect an additional penny on each day going forward for the length of the challenge. So you would collect $0.01 on day 1, $0.02 on day 2, $1 on day 100, and so forth.

If you do the challenge for a year, you’ll have $667.95! That’s enough for a nice weekend getaway. I don’t call this blog From Pennies to Plenty for nothing!

Pro: This challenge is straightforward and easy to do. You can probably find loose change around the house to start your collection.

You likely can still manage to scrape together $20+ a week for the final weeks of the challenge. Because this challenge is easy to complete, you’re more likely to complete it and come out with several hundred dollars in savings.

Con: While the Penny Challenge is a step up from not saving, $667.95 is not saving much over the course of an entire year. If you’re at a higher level of income where you know you could be saving more, then you hopefully are saving more.

3 | Coin Jar Challenge

The coin jar is as basic as it sounds. You have a jar (preferably a large jug) where you put your excess change at the end of the day.

A great way to get started doing this is to use a small wallet that doesn’t hold coins. You’ll place those coins in your pockets and elsewhere where it’s inconvenient and uncomfortable to carry. So you’ll place those coins on the jar each night and watch it grow.

Did you do one of these as a child? I did and it was so much fun.

Nowadays I joke with my husband that a Talenti ice cream container in our living room is our honeymoon fund. Thankfully, we’ve filled it to the top!

4 | Bring Lunch to Work Every Day

A few years ago, I read about celebrities doing the Food Stamp Challenge. Do you remember it? The idea was to live off the average U.S. food stamp benefit of about $30 per person for a week.

Some of you frugal peeps might say that’s easy-peasy for you! You’re great at frugal living!

But if you find yourself spending too much money on food, specifically eating out, one easy way to cut back is to bring your lunch to work every day.

It might sound tough because you (or your partner) will have to meal plan. It’s doable though with just a few more minutes a day:

Make more of dinner the night before and pack it for lunch the next day

Cook a huge batch of the same meal on Sunday night for the week ahead

Buy foods that are easy to put together into a meal like lettuce and chicken as part of a salad

Even microwavable meals (bought on sale) can save you money. You might be able to store them at work and heat them up in just a few minutes.

This challenge is for only 30 days. You can do it!

5 | Eat at Home for 30 days

Cooking your meals at home is another easy way to save money. This can be a bit tricky because some foods like a large take-out burrito cost $10 and can last two meals while foods like scallops or sea bass can cost you $30 for just one dinner at home.

So it’s important to take things a step further and cook relatively frugal meals. You can eat fancier food from time to time, but most meals should be economical.

Meal planning will make it easier to eat in every day. I used to wing cooking each day and still do from time to time, but I try to plan my meals for the week each weekend before. It’s given me so much more peace of mind and time to do other things during the week.

If you’re new to meal planning, try $5 Meal Plan to get started. Each week, you’ll be emailed recipes for several delicious meals where each meal costs less than $2 per person.

You just have to buy the ingredients and cook the meals, but the planning is done for you.

The $5 Meal Plan starts with a 14-day free trial and then it costs $5 per month for the meal plans.

Imagine how your savings account will grow when you’re sent meal plans that save you money every week!

6 | Free Entertainment Challenge

Entertainment is a touchy issue when it comes to budgeting. You know you like it and want it, but it’s not a necessity for you to live.

That makes it one of the easiest places to cut back on spending so that you can meet your savings goals. Some people find this to be torturous. There’s nothing worse than being bored!

Rather than thinking of this challenge as torturous or boring, try seeing it as an opportunity to find new things that entertain you. A challenge like this typically only lasts a month so you’ll be through it soon enough.

This is seriously one of my favorite challenges though. A few years ago, I looked over my expenses for one month and realized I had spent nothing on entertainment. I was so happy and pleased with myself that I decided to keep it going.

It didn’t work out well in the long run because eventually, I wanted to go out with people and enjoy myself that way, but I was able to do it for over a month with little effort.

Not sure how to entertain yourself for free? Find 101 things to do instead of spending money in the FP2P Free Resource Library.

7 | No Spending Challenge

You might be looking at the above challenges and think that you still wouldn’t save enough. In that case, it’s time to up the ante and do a no spending challenge.

You don’t spend any money beyond what’s absolutely necessary. Cut out eating out, paying for entertainment, unnecessary subscriptions, and so forth. Do this for a month or more and you’ll see even more savings.

Related post: How to Succeed at a No-Spend Challenge

8 | $5 Saving Challenge

In this challenge, you save every $5 bill you come across in your daily life. It doesn’t matter whether you took out $5 at the ATM or someone gave you it as change for a purchase.

If you have it in your wallet, it gets taken out and saved. Imagine saving one $5 bill a week.

You might not even notice it missing. After a year, you’d have $260. If you saved two $5 bills a week, also reasonable, you’d have $520 after a year.

Some people might see numbers like $520 or $667.95 after a year of savings and think that these numbers are too little to be worth saving. But if you found $520 on the street, would you throw it in the shredder?

If you got a bonus for $667.95 at work, would you turn it away and say no thanks? Probably not.

In my household, those amounts could pay for groceries for at least two months. They would cover several months of entertainment or even a weekend getaway.

The best thing we could do with that money is to invest it. Put it into an investment account, whatever your preference is, and watch that money grow over time.

When you look at it that way, those few hundred dollars aren’t chump change anymore. Putting away a few dollars every day can have a huge impact on your life.

Are you inspired to try any of the challenges? Let me know how it goes. I’ll be here cheering you on!

What money challenges do you like? Have you tried any? How did you motivate yourself from beginning to end? Why did you try one?